Web-based accounting software helps small businesses and medium-sized companies complete financial tasks from any device with an internet connection. We researched reviews from real users to gauge their opinion of each platform. We wanted to get their opinion about how simple the software was to use and that, according to recent users, the companies provided satisfactory customer service. Generally, Xero is easy to use, and you can set up your company information in no time. However, a huge downside is that it doesn’t provide live chat support like QuickBooks, FreshBooks, and Zoho Books do. Meanwhile, in terms of online data security, Xero employs industry-accepted measures, such as multifactor authentication (MFA), customized user access setup, and data encryption.

Always working with the latest software version

Costs can vary greatly among different cloud accounting service providers. QuickBooks Online offers a free, 30-day trial of its online accounting software. This cloud accounting online software offers the usual browser compatibilities, plus applications for Android and iOS mobile devices.

- Xero is a program that will convert the quotes and estimates into invoices and allow you to charge the customers when you have supplied them with goods or services.

- Several programs we evaluated let you add more than one business to your account, though some companies charge extra for this convenience.

- Generally, Xero is easy to use, and you can set up your company information in no time.

- You can choose a basic system and add à la carte options such as project management or CRM, or you can choose an all-in-one system that includes everything you need.

Intuit QuickBooks Online

On top of that, the free option offers a customer portal, automatic payment reminders, mileage tracking and the ability to schedule reports. Higher-tier plans let users automate workflows and track project profitability, and give access to advanced inventory and analytics tools. QuickBooks Online is an industry leader in the accounting field, thanks to its strong feature set and scalability. In addition to core accounting capabilities, it has robust reporting and transaction tracking tools, invoicing capabilities, inventory management features and mobile app functionality. This accounting data is sent to the cloud, processed on a remote server, and then returned to you as a user.

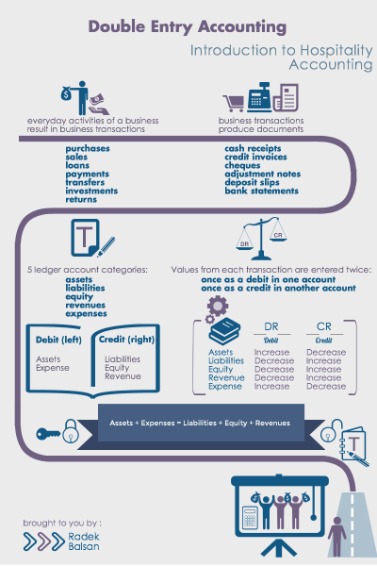

Example of cloud accounting

Analytics based on historical and real-time data may also help with predictive modelling, giving practices the ability to deliver better advice to guide strategic client business. This can inform pricing, resource allocation, https://www.simple-accounting.org/ and investments—helping you make smarter decisions grounded in data. With data securely and immediately accessible in the cloud, there’s endless opportunities for accounting practices to grow and optimise their data.

When I clicked “+ create,” then “invoice,” I was taken to a long form to fill out to create an invoice. It was highly customizable, allowing me to answer details about the invoice that would aid in filing it in my storage system and making it searchable. For accumulated depreciation example, I began by entering basic invoicing information, such as the vendor’s name, the invoice number, the date and the amount and due dates. This list was highly customizable, a theme I would experience while testing different features on the platform.

They also like that it has lots of reporting features and easy data backup capabilities. The software even allows a breakdown of tracked time based on billable and non-billable activities within each project or job. From there, you can track job progress based on its income, expenses and profit margin, then easily turn timesheets into invoices. Time billing reports further allow you to view time billing for activities, customers, employees, jobs, rate levels and productivity. Overall, Xero offers a basic interface for completing key accounting tasks.

This can save your company time and money by not having to employ an in-house IT representative to deal with the software. Cloud-based accounting software is hosted online, so you don’t need to buy a program to install it on your computer. Wolters Kluwer uses integration features within CCH iFirm to enable you to connect with bans, HMRC, and clients, thrking systemough your online cloud software. Wolters Kluwer is a global provider of professional information, software solutions, and services for clinicians, nurses, accountants, lawyers, and tax, finance, audit, risk, compliance, and regulatory sectors. If you’re working with a desktop based accounting system, you will have to constantly update the software which takes time away from your day. It works by logging onto an online solution and conducting your work from there.

Wave is a free accounting service that is designed for small businesses just starting out. The easy-to-use software has all the basic features needed to keep your accounting department in order. Wave’s built-in dashboard makes it easy to quickly access and understand your business’s financial information. Another outstanding feature is the fact an unlimited number of users can be added.

Most cloud platforms will also have an open application programming interface, or API. This means that you can connect third party software with your system and fully integrate your processes. Make Xero your own by connecting other apps to the Xero accounting software. Xero’s project-based billing tools are ideal for businesses that need to track materials and labor costs, ensuring each project stays on track and profitable. Regardless of the pricing model you select, watch out for hidden fees.

There are so many features and functionalities empowered by cloud accounting that the list goes on. You can connect payment apps to your cloud accounting software allowing you to pay and be paid automatically. This helps to speed up payment times and reduces the level of administrative work that you or your staff are required to complete. If your business sends invoices, the ability to email them and accept online payments helps you get paid faster. Most accounting programs integrate with third-party payment processors; others require you to use their in-house processing services. Consider what you need the accounting software to accomplish for you and your business, and seek out software that will help you accomplish these tasks with ease.

We considered factors such as pricing, customer support and user reviews. We also considered features such as invoicing, time tracking, expense tracking, mileage tracking, inventory tracking and financial reports. Xero Accounting offers a user-friendly interface that is easy to learn, even if you’ve never used accounting https://www.simple-accounting.org/outstanding-checks/ software before. Its entry level plan is affordable, though it’s best suited to freelancers, solopreneurs and small businesses since it only allows 20 invoices and 5 bills per month. Other features include financial reporting, project and time tracking, documentation management, expense management and payroll acceptance.

So, even if your laptop gets stolen, no one will be able to access the data without your password as the data has no contact with any hardware. In QuickBooks Online, you can reorder products by automatically creating purchase orders and automate all parts of the sales cycle. Also, you want to be sure that the app works within your platform, as some or compatible only with iOS devices, and others can be transmitted to smartwatches as well. Wave, for example, allows you to maintain more than one business individually under a single account. To acquire the license pricing, you will need to contact NetSuite’s team. The software will always keep you in line with the latest tax rules, ranging from compliance requirements to EU-VAT complications, along with encrypting all your activity with PCI Level 1 certification.

FreshBooks is an affordable accounting solution that will help you wow your clients with stunning invoices, and the mobile app allows you to stay connected with your team and regulate the cash flow from anywhere. Check out the Xero App Store to find, try and buy business apps that connect easily to Xero online accounting software. Apps like Stripe, GoCardless, Shopify, and WorkflowMax connect seamlessly and sync data with Xero business accounting software. Fortunately, many cloud accounting software platforms charge you month-to-month, so you’re not locked into an annual contract if you do change your mind and decide that you need to switch later on. Time tracking is essential for many activities, such as paying hourly employees and charging clients on a per hour basis.

Unlike other software programs that needed to be installed with individual licenses on each computer, access to the cloud is available on a web browser or mobile app where you can log into the account. You will also save money on an in-house IT team to do things like upgrade software or deal with other technical issues. If you are a small business or a startup, consider QuickBooks Simple Start. Businesses that provide services, rather than goods, should consider the QuickBooks Essentials plan. Businesses with inventory will likely get the most benefit from QuickBooks Plus.

Cloud accounting software helps by showing you things like how much tax you owe (even down to specific invoices) or how much you’ve paid overtime on a specific tax. Cloud accounting software like QuickBooks makes it much easier to compile the information you need to file a successful remittance. With cloud accounting in place, you can quickly spot a gap in cash flow or see if customers are abusing your extension of credit. Business owners who simply place all of their receipts in a drawer to deal with at a later date might not catch a potential issue until it’s too late.